December capped off a surprisingly strong year for Canada’s housing market, as record-high savings, low-interest rates, and changing consumer demand pushed home sales and prices to record highs. Although the market showed signs of cooling in the fourth quarter, December data confirmed that housing demand remains elevated compared with the historical average.

Canada’s Housing Market: By the Numbers

Canada’s real estate market ended the year on a positive note, as home sales surged to all-time highs. National home sales rose 7.2% in December and 47.2% annually, according to the Canadian Real Estate Association (CREA). The number of newly listed properties increased by 3.4% compared with November.

Canada’s housing market ends the year on a high. | Source: CREA

Gains were primarily driven by activity in the Greater Toronto Area and Greater Vancouver Area. Both regions recorded gains of more than 20% month over month.

Costa Poulopoulos, Chair of CREA, said:

“It’s official, despite all the challenges, 2020 was a record year for Canadian resale housing activity.”

Of the 40 markets tracked by CREA, only one reported a monthly decline in the average home price. On a national basis, the Home Price Index rose 1.5%. CREA said there were just 2.1 months of housing inventory at the end of December, with 29 of 40 local markets having less than one month of available supply.

Labour Market Recovery Slows

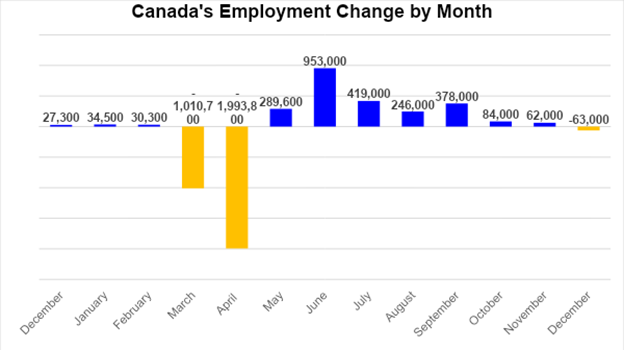

Following seven consecutive monthly gains, Canada’s labour market witnessed a decline in December, as new Covid-19 restrictions reverberated across the economy.

Statistics Canada reported a net loss of 63,000 jobs in December, offsetting the previous month’s gains. Part-time employment fell by 99,000, and self-employment decreased by 62,000.

The jobless rate edged up by 0.1 of a percentage point to 8.6%, official data showed.

The statistics agency said that, by December, 1.1 million Canadian workers were impacted by Covid-19 restrictions, compared with 5.5 million in April.

Toronto entered a new lockdown on November 23, with the Ontario government extending those restrictions to Windsor and York before declaring a province-wide state of emergency. Alberta, Saskatchewan, and Prince Edward Island also introduced new lockdown measures in November and December to contain growing infection rates.

Housing Market to Hit New Highs in 2021, but Soft Landing Likely: RBC Economics

Canada’s “supercharged” housing market could be headed for all-time highs in 2021 before we see a tapering off towards the end of the year, according to new research from RBC Economics.

Robert Hogue, RBC’s senior economist, forecasts home resales to hit 588,300 units this year, up from 552,300 in 2020. Surging demand, combined with stubbornly low supply, will push the national average home price up by 8.4% to $669,000, he said. At that point, Hogue expects the market to cool down.

Hogue wrote: “Historically low interest rates, changing housing needs, high household savings and improving consumer confidence will keep demand supercharged.”

Canadian Stocks Hit All-Time Highs

North American stocks rose to record highs in January, with the TSX Composite Index climbing above 18,000 for the first time. The Canadian benchmark peaked at 18,058.61 on Jan. 8, before experiencing a slight correction.

On Wall Street, the S&P 500 and Nasdaq Composite both reached new highs, buoyed by stimulus optimism and political clarity in Washington after Democrats took control of the Senate.

Even with U.S. equities returning to all-time highs, the CBOE VIX — a key measure of investor anxiety — remains well above the historical average. The so-called “investor fear index” peaked in the high 20s in early January before backtracking slightly later in the month. Typically, VIX readings above 20 signal volatile trading conditions for U.S. stocks over the next 30 days.

Conclusion and Summary

Many investors view 2021 as the year of recovery as more countries slowly emerge from pandemic-induced lockdowns. Although the worst of the economic downturn may have passed, the Covid-19 pandemic remains in full swing. Maj.-Gen. Dany Fortin, the commander leading Canada’s vaccine rollout, said deliveries are likely to ramp up beginning in April. That potentially leaves two-and-a-half months of uncertainty for the Canadian economy. Prime Minister Justin Trudeau said as many as 20 million Canadians could be vaccinated by the end of the second quarter.

What Happens Next?

CMI Group will continue to analyze market changes and keep you updated on a regular basis. Visit our website to learn more.