While investing in mortgages, a properly managed fund results in high returns. We do this by not being complacent when evaluating the underlying assets that we are investing in.

CMI’s team is dedicated to providing opportunities to investors that are highly scrutinized and undergo numerous checks through our rigorous underwriting process. The loans we offer are available in flexible lending options to make each mortgage transactions quick and easy for our clients.

Unlike many other forms of investment, investing in mortgages offers a way to hedge the market against market cycles. Your investment is backed by the security of the real estate itself. Your investment is fully secured by real estate, with properties that are appraised and borrowers undergo extensive qualification.

Transparency is offered with a complete package featuring all of the reports, information, and due diligence on each loan. Our private mortgage investments have the benefit of a high yield and monthly distributions, with no risk of daily or monthly price fluctuations providing for not only income security but also stability.

At CMI, we believe that due diligence is both an art and a science. We spend a considerable amount of time identifying investment opportunities that meet our rigorous lending standards.

We then spend even more time trying to identify the “story behind the numbers” and whether the opportunity fits our growing portfolio of mortgage opportunities for our investors.

Our investment research goes beyond simply qualifying each individual investment deal.

Our extended efforts to understand the industry and its underlying fundamentals focus on framing the investment opportunity for value creation through deep market analysis.

Your investment is our business. CLI is dedicated to providing investors with mortgage investment opportunities that result in healthy returns with minimal risk and zero fluctuation. We usually secure a private mortgage through a single investor, but we also allow multiple or split investors for loan transactions. Either way, our goal is to maximize benefits for our investors.

Here are some of the benefits you can enjoy when you invest with us:

Of course, mortgage investing is not without its risks but choosing an investor-centric company like CMI lessens that uncertainty.

We will never leave you alone after closing a deal. At zero cost to the investor, we will secure your investment, keep the payments flowing, and ensure transparency all the way through.

We assist clients choose the right assets that best suit their needs, and then manage following closing ensuring that our recommendation pays off.

We can fully integrate with existing operations of individual investors and investment companies, including working with your legal team and customizing our documentation to accommodate your workflow processes.

We will facilitate the closing via our experienced external law firms, and can even manage the investment after closing at no cost to our investor. It’s our mission to provide convenience and a hassle-free experience.

After making the investment, you can essentially sit back and watch your returns roll in, knowing that that CMI is working for you.

Diversifying investments involves the idea of creating a portfolio with multiple investment categories to maximize results and reduce risk. At CMI, we build your portfolio and diversify your mortgage investments wherever you are in Canada. We let you decide what specific market segments you prefer and break your capital into multiple loans. Whichever it may be, our goal is to maximize your returns.

CMI has a proven track record of over $2 Billion successful placements. We ensure successful transactions through a careful assessment of each mortgage application and finding a perfect match between borrower and investor. A handful of factors including loan size, location, and yield preference of investors are taken into consideration when evaluating potential investments. Deals are closed through our partner law firms to ensure transparency and security.

We provide well-packaged mortgage investment opportunities.

We increase the investor’s access to more valuable mortgage investments.

We keep the investor’s capital on the move and save downtime.

We have a massive and strong network of mortgage investors nationwide.

We understand the value of time and ensure your capital is not sitting idle and is always at work. We are able to integrate with your current investment system, work with your legal team, and even customize every transaction to suit your process.

At CMI, we offer safe investment options with the right risk-reward ratio through our “matching system” so we know what loan opportunities work best for our investors. Here is how our loan process works:

To ensure you reach your goals, our mortgage team has designated roles that function as one. Each department works as part of an integrated platform ensuring a seamless experience where expertise operates in an effective coordinate manner:

A great advantage of private mortgages is the virtually endless variety, which makes it relatively simple to find opportunities that fit your needs. Each investor has specific investment goals and risk tolerances. We take time to assess and understand your needs to craft a personalized investment for you.

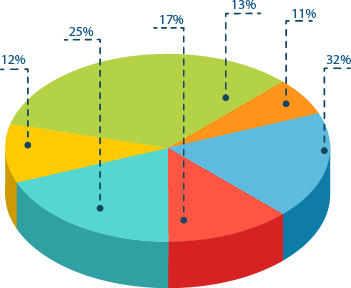

A variety of private mortgages in different locations, secured by different types of real estate and varying levels of returns provides us an opportunity to meet each investor’s criteria.

We source, and then analyze all investment opportunities presented to us. After careful analysis, only the best ones are packaged and then presented to our investors based on loan size, location, and the yield preferences of each of our investors.

We have access to private mortgage opportunities across Canada and in different property segments from residential property to retail strip plazas and construction financing. Whatever your flavour and volume demand is, we can help build a diversified and scalable portfolio for you.