Economists spend a lot of time and effort predicting what central bank policy makers are thinking. Over the past few years, central banks have become more transparent in their policy-making process. Central banks, through their speeches, publications, and meeting summaries, provide the public with information on the policy-making process and the likely course for interest rates.

When central banks make their policy decisions, they are guided by forecasts. We seldom know the central bank’s forecast for the economy and inflation, but we do have market data that we can use to infer what the market thinks will happen at upcoming policy setting meetings.

Predicting the future course of monetary policy is of tremendous importance to financial markets. Traders use futures contracts on short-term interest rates that are either targeted by the central bank, or a close proxy for that rate, to infer market expectations of future policy decisions. This approach is appealing because producing the forecast is simple – rates from various contracts can be obtained directly from future exchanges on a real-time basis – and the forecast itself is typically highly accurate.

While there is a technical debate about risk premiums in these forecast models, they do provide a simple and easy indicator of the likely course of central bank policy actions.

In the US, we can use the Fed funds futures contract as a tool to determine the latest probabilities of a rate move by the Federal Open Market Committee (FOMC). Luckily, we do not have to build a tool as the Chicago Mercantile Exchange already publishes the CME FedWatch Tool.

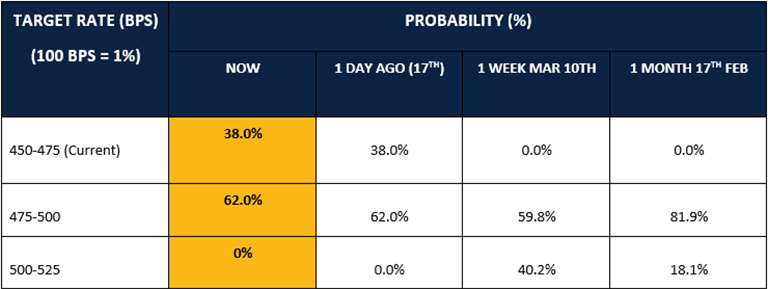

For the March 22 Fed meeting, the forecasted rate changes (as of March 19) are:

We can see how dramatically expectations have shifted over the past week as concerns about the banking system are weighing on the market.

In Canada, there is a similar tool that uses the futures contracts on the 3-month banker’s acceptance. The TMX Montreal Exchange provides a Canadian interest rate expectations tool. The tool provides quarterly expectations of rate movements and their probabilities. Currently, the tool indicates that for June, there is a 100% probability of a 50 bp decline in rates. For September, there is an implied probability of 88% of a cumulative decline of 75 bps.

While much of this expectation is driven by current developments in the US, it still provides a useful window on current financial market expectations for overnight rates.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.