The Bank of Canada has announced several interest rate increases throughout 2022 in an effort to battle rampant inflation. The resulting increase in interest rates has more and more Canadian borrowers struggling to qualify for mortgages with banks and credit unions, and a growing number are turning to private lenders for their home financing needs. Not only do private lenders fill a gap in the mortgage market by offering flexible solutions to help borrowers that do not qualify for financing otherwise, many private lenders are also ahead of the curve with technology and digital services they offer to brokers.

Amidst these uncertain economic conditions, a growing number of borrowers are relying on their mortgage brokers for guidance on their best options. According to a 2022 Mortgage Professionals Canada consumer survey, one in four respondents cited the advice provided by their mortgage broker as a key factor in choosing a mortgage. Providing sound advice begins with guiding borrowers through the basics of the different types of lenders and mortgages, and discussing which may be best suited for their needs. Here’s a look at some of the key differences between traditional, alternative and private lenders.

Types of lenders

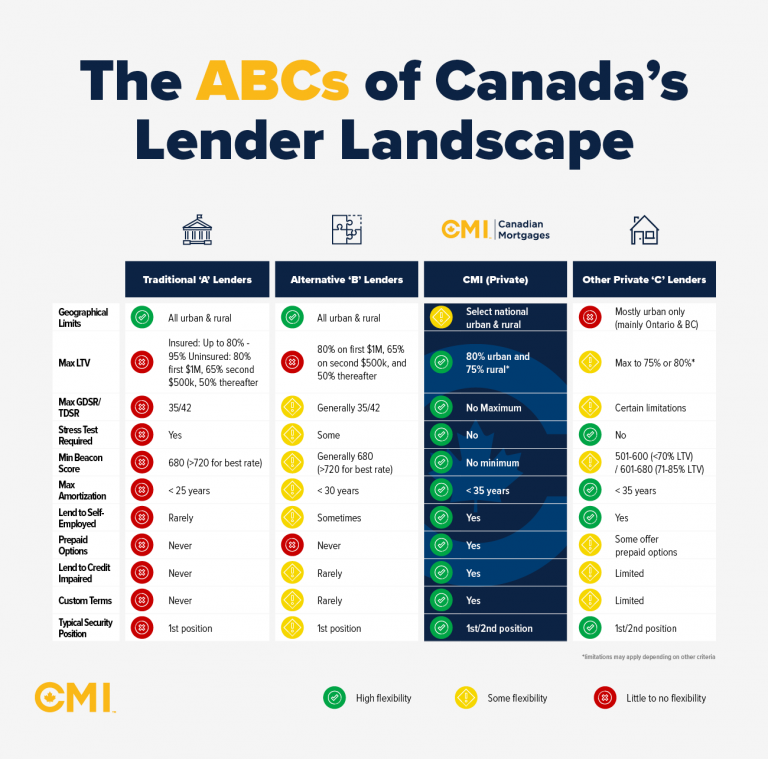

There is a wide spectrum of mortgage lenders in Canada, offering a variety of loan options for borrowers of different financial and employment backgrounds. These lenders fall into three main categories: traditional (‘A’), alternative (‘B’) and private (‘C’) lenders. It’s important for borrowers to understand the differences, what type of mortgage they qualify for, and which type of lender can best support their needs.

Traditional ‘A’ lenders

The big five Canadian banks are the most popular lenders. These large, federally regulated institutions offer prime mortgage rates to borrowers that represent the lowest level of risk and fit within their strict eligibility guidelines. Banks usually only lend to borrowers that have good credit, can pass regulated stress tests, and can demonstrate consistent income and manageable debt ratios. While banks traditionally offer the lowest available borrowing rates, they have a much more stringent, and often lengthier, approval process, and it is more difficult to qualify for a loan.

Alternative ‘B’ lenders

Alternative lenders tend to be smaller financial institutions like credit unions and trust companies. These lenders can offer mortgages to borrowers who have good credit history and stable income, but do not meet other prime lender requirements. For example, provincially regulated credit unions are able to bypass the federal stress-test rule and instead use a contract rate as the qualifying rate for the borrower’s mortgage application.

Alternative lenders offer financing similar to banks, but lend at higher interest rates compared to banks because of their slightly more flexible approval criteria. In some cases, alternative lenders can offer a higher mortgage amount to a borrower that would be approved by a conventional lender for a lesser amount.

Monoline lenders, which exist solely to provide loans to borrowers, are also considered alternative lenders. Monoline lenders can include publicly traded corporations, mortgage investment corporations (MICs), and non-publicly traded corporations. While these lenders may offer rates competitive with banks and other ‘A’ lenders, they have the ability to dictate their own approval criteria, terms and conditions. Due to the wide variability among these lenders, it’s important to compare and consider the individual lending criteria and terms of each one, respectively.

Private ‘C’ lenders

There are several different types of private lenders, from individuals to businesses of various sizes, that lend money from private sources. Private lenders are not tied to any bank or credit union, so they are not subject to the same strict regulations and set their own terms and conditions. As a result, private lenders also offer significantly more flexibility in the approval process.

Private lending is designed for different circumstances than traditional lending. These lenders lend to borrowers that may not qualify under traditional guidelines. For example, a private lender can assist borrowers who are out of work, facing short-term cash flow challenges or have poor credit history. Private lenders can also secure funding for self-employed clients or business owners, newcomers to Canada, or those looking to buy a more rurally-situated property.

Private lenders offer product solutions that are unavailable from conventional lenders, such as second mortgages, and can create flexible repayment terms like interest-only and prepaid mortgages. Terms can be customized to provide funds for short-term needs as brief as just a few days, and private lenders will review deals for clients with challenged credit that other lenders will not consider.

In terms of the mortgage underwriting process, private lenders do not need to focus as heavily on a borrower’s financial history. Instead, they take a ‘big picture’ view and consider a range of other factors to approve a borrower, such as existing equity, while still ensuring a prudent lending decision that considers things like affordability and ability to repay.

Interest rates are generally higher in the private lending space due to the elevated risk profile of many borrowers, but they are not necessarily significantly higher than those charged by conventional lenders. Most private lenders price mortgages on a case-by-case basis according to a number of factors, including the property type and location, the loan-to-value, security position, as well as the client’s credit worthiness and their ability to make payments.

A private mortgage can be a valuable alternative for borrowers struggling to qualify with an ‘A’ or ‘B’ lender, particularly in the current economic environment. By design, private loans are intended as a short-term solution, a ‘bridge’ to solve an immediate problem or need, with a built-in ‘exit strategy’ to transition back to traditional lenders. Private lenders offer valuable shorter term solutions that can help borrowers get the financing they need, while improving their financial standing.

Applying for a mortgage

The application process for each type of lender varies. Applying for a loan with a bank or credit union requires significant preparation, documentation and time. The application process tends to be more complicated, and requires brokers to build a strong financial profile for their clients with detailed supporting documents for the best chance of securing an approval. In the application, brokers must demonstrate the borrower has a strong credit score and a track record of repaying debts and other obligations like credit cards, lines of credit and student loans.

The application profile must also include proof of employment, tax returns, investment statements and any other records that can establish employment, financial stability and responsibility. In many cases, the application must be submitted, and following approval, signed in person at the bank. The turnaround time can be as lengthy as several weeks, depending on the complexity of the deal, approval conditions and documentation required. A lengthy turnaround time can place a real estate transaction in jeopardy if it contains conditions related to financing. Such conditions typically have short and firm expiry dates.

While alternative lenders have looser requirements and a less intensive underwriting process compared to traditional lenders, private lenders offer the greatest flexibility in the application process because they do not require as much documentation or depth of detail around a borrowers’ financial background. Private lenders are able to use different factors to assess a borrower’s risk profile. They can work with smaller and shorter term loans that require less background information, making a faster lending decision, typically within a week. CMI in particular is well known for often approving applications within hours.

Broker-lender collaboration is also a differentiator. Private lenders often provide advice and help to structure deals in partnership with the broker, with the goal of delivering the most suitable solution based on the borrower’s unique situation, while considering market conditions in context as well.

Qualifying for a mortgage

All lenders use different underwriting criteria when reviewing credit applications and arriving at a lending decision. Traditional ‘A’ lenders have a rigid approval process that focuses on income, credit scores, debt ratios and federally regulated rules, such as the mortgage stress test. While some alternative ‘B’ lenders apply the stress test, borrowers generally don’t need to prove as much income as required by the banks. Stated differently, alternative lenders will consider deals with a higher total debt servicing (TDS) ratio compared to banks.

Alternative lenders will rarely consider a mortgage amount with a very high loan-to-value (LTV) ratio, whereas private lenders may be more flexible. Private ‘C’ lenders can focus on other aspects of a borrower’s financial standing, including the value of property they already own. Private lenders can also look at alternative forms of income, including sales commissions, tips, or earnings from self-employment. They will also look at income from ‘gig’ work, which is considered a non-traditional income source and falls outside of the B20 regulations to which ‘A’ lenders must adhere.

The bottom line

Private lenders like CMI offer flexible and efficient borrowing solutions, particularly where borrowers have been rejected by banks and credit unions. Although banks offer the lowest rates, private mortgages are a natural fit for clients with less straightforward financial histories and may be without other financing options. Private lenders enable mortgage brokers to serve a broader range of clients, with a broader range of solutions, and can help close deals fast. For brokers, working with a trusted private lending partner is more important than ever.

Talk to CMI today to learn more about partnering with Canada’s premier private mortgage lender and a leader in the private lending market since 2005.