Canadians’ confidence in their ability to repay their debt has hit a record low, according to a report by debt consultancy firm MNP. As a result, many households have resorted to credit to make ends meet, especially as the pandemic stretches on. MNP also found that 21% of those surveyed are only making their minimum credit card payments. While it’s important to at least make those minimum credit card payments, you should caution clients about how quickly high-interest credit card debt can grow and get out of hand.

There is significant value in reviewing the basics of how credit card interest works with clients. Cardholders are charged interest on any unpaid balance whenever they can’t pay their bill in full each month. The credit card company then adds that amount to the balance. In the following month, and if the cardholder again does not pay off the outstanding card balance in full they end up paying interest on their balance owing again, which includes the previous month’s interest. Each month, credit card companies calculate the amount of interest by multiplying the principal amount by the interest rate for that month.

Example 1:

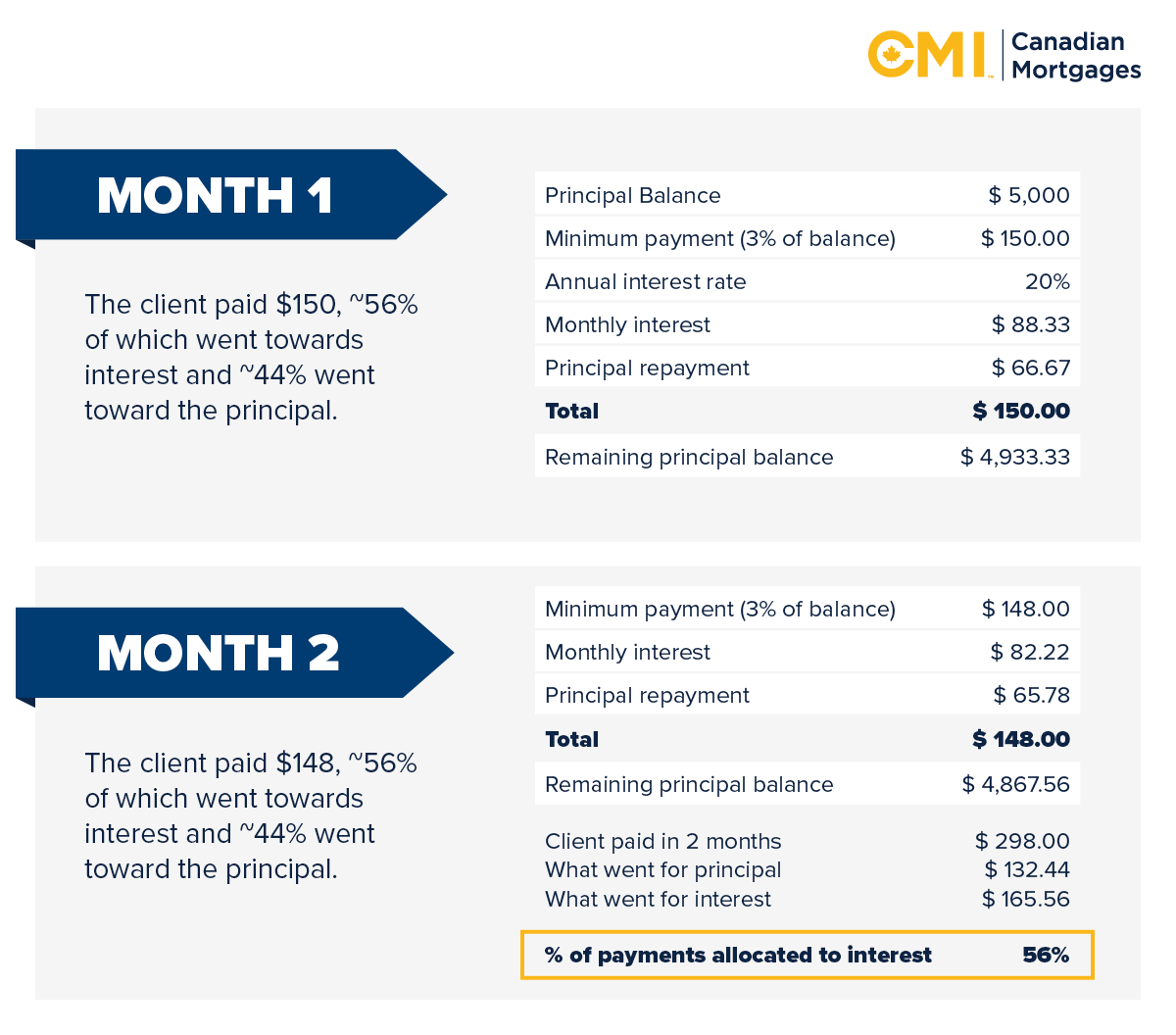

The client has a credit card with a principal balance of $5000, and makes the minimum monthly payment of $150. The interest calculation for a credit card with a 20% annual interest rate would look like this:

In this example, the client has paid $ 298 in two months but only $132 went to repaying the original balance. Approximately 56% of the monthly payment was interest. It’s not long before this becomes a losing battle, taking years to pay off.

If your client is carrying balances on multiple high-interest credit cards, consolidation and leveraging the equity in their real estate can be the best solution for immediate relief.

Debt consolidation is the process of paying off multiple debts with a new loan (e.g., a private mortgage), and can simplify your client’s finances, reduce their interest costs significantly, improve their cash flow and relieve a great deal of stress. Debt consolidation loans often carry a much lower interest rate, which allows your clients additional time to pay off their debt without it negatively impacting their beacon score.

Example 2:

Clients have a home worth $800,000 and a 1st mortgage with a bank owing $550,000. They also have high-interest debt on multiple credit cards.

If your client is interested in consolidating their debt, a private mortgage can be a great option, especially if they have a low beacon score, a nontraditional source of income, or if they generally struggle to qualify for financing with their bank or other traditional lenders. A private mortgage allows your client to leverage the equity in their home and provide them with easy access to credit, at a much lower interest rate.

CMI can offer flexible, shorter term private mortgages, meaning you can help clients get out from under their debt in as little as six to 12 months. As soon as your client closes on the second mortgage, their debts are paid immediately and they will see a major increase in their Beacon score. Provided they stay on track and keep up with their payments, they will likely be able to qualify for traditional financing later down the line.

Remind clients that if they carry a large amount of credit card debt and don’t act on it, that debt will continue to grow and negatively impact their Beacon score. Particularly if they already have challenges with their credit, it’s important to help them on the path to a better financial position.

Nobody knows you like we do.

We know brokers because we started as one. Partner with CMI today. Learn how CMI helps build business, not compete for it.